Key Takeaways

- Bitcoin transactions have fallen 55% from peak levels, hitting a 12-month low.

- Bitcoin-based protocols like Runes and Ordinals now make up just 1% of transactions.

- Speculative trading has shifted to networks like Solana and Base.

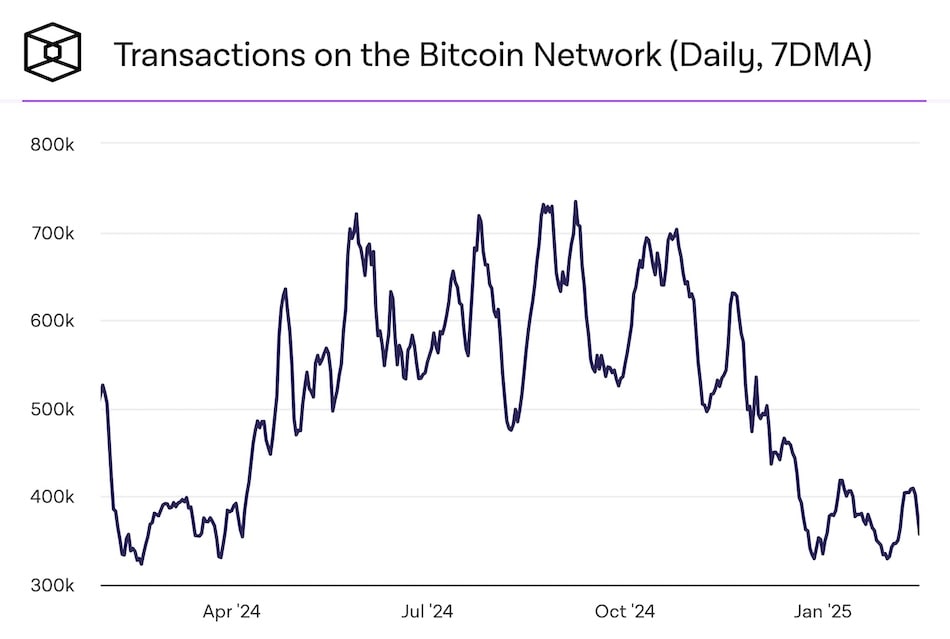

The 7-day moving average of Bitcoin transactions has reached 330,000, marking a 12-month low from the 730,000 transaction peak recorded in 2024.

This decline signals a shift in how Bitcoin’s network is being utilized, with speculative activity slowing.

Fee stabilization & protocol usage

Transaction fees have also stabilized at around $500,000 per day, a sharp contrast to previous spikes in late 2024.

Bitcoin-based protocols like Runes and Ordinals, which initially drove speculative demand similar to Ethereum’s ERC-20 tokens and NFTs, now account for just 1% of total transactions.

Fee revenue from Runes has plummeted to $20,000 in the past 30 days, compared to $60 million on launch day.

Migration to alternative networks

Market trends indicate that speculative traders have migrated to other blockchain ecosystems.

Memecoin trading has shifted toward Solana, while AI-related tokens have gained traction on Base.

Despite Bitcoin’s dominance in market capitalization, these alternative networks are attracting niche activity and trading volumes.

Future outlook

With reduced transaction activity and lower fees, Bitcoin is returning to its core function as a monetary transfer network.

Whether new Bitcoin-based protocols can revive network engagement remains to be seen, especially as block rewards continue to diminish over time.