Key Takeaways

- Bitcoin open interest surged by $1.3 billion following the Fed's minutes.

- The minutes increased speculation of a September rate cut.

- Bitcoin futures market saw a near-even split between long and short positions.

Bitcoin open interest surged by $1.3 billion in just 12 hours after the Federal Reserve released its July meeting minutes on August 21.

The minutes suggested a likely rate cut in September, which fueled speculation and activity in Bitcoin futures markets.

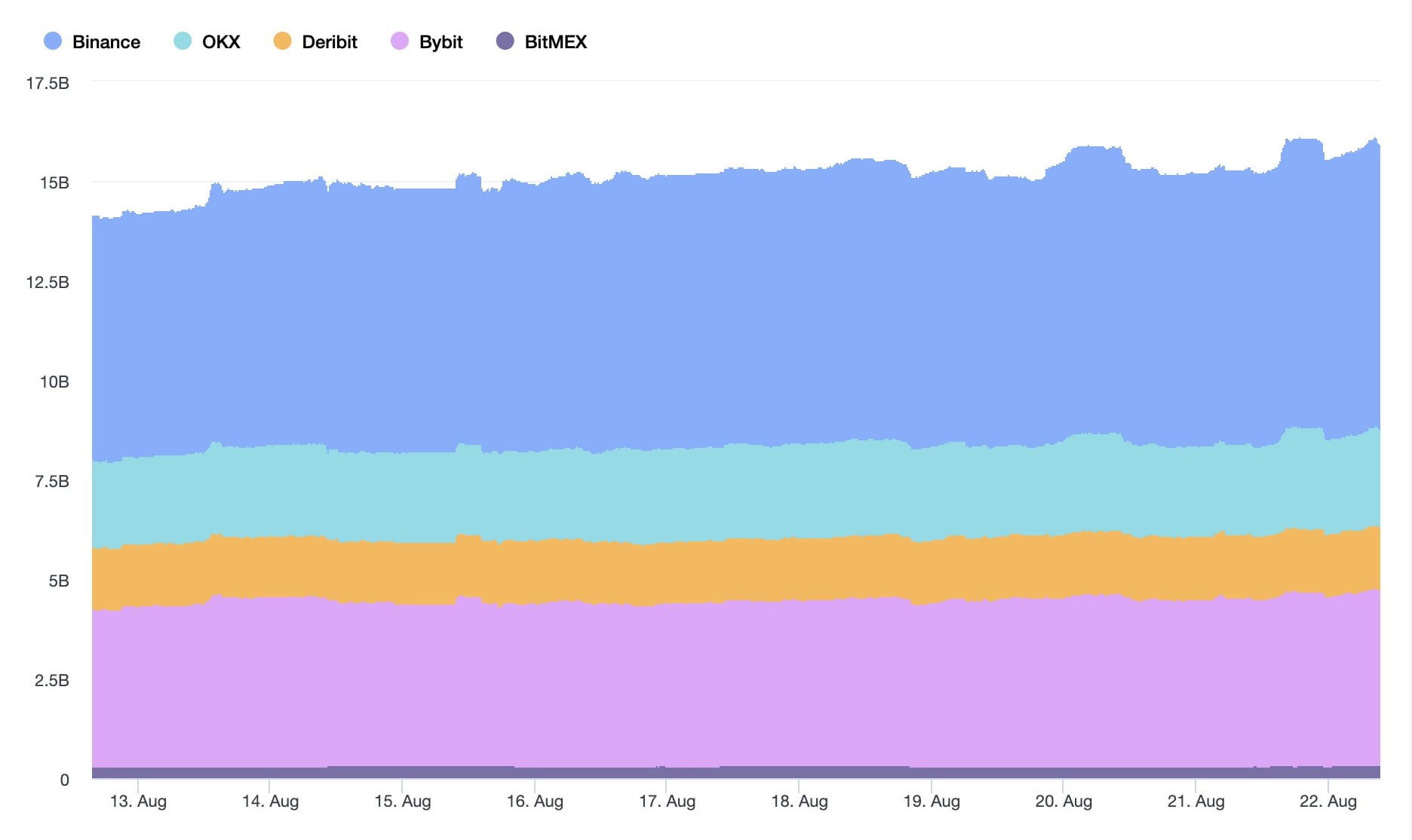

On August 22, Bitcoin futures open interest (OI) reached $31.92 billion, reflecting a $1.26 billion rise. Open interest refers to the total number of unsettled derivative contracts, including futures and options. This increase indicates greater trader confidence in predicting Bitcoin’s price direction.

The market remained divided on Bitcoin’s future price, with long positions holding a narrow lead at 50.63% compared to 49.37% short positions, according to data from CoinGlass. At the time, Bitcoin was priced at $60,623, a level it has maintained since August 9.

Markus Thielen, head of research at 10x Research, stated in an August 22 report that the Fed’s minutes made a September rate cut “almost a certainty.”

Another trader, Sykodelic, suggested that Bitcoin was poised for a breakout, citing the Fed’s dovish tone as a key driver.

Nishant Bhardwaj, a prominent Bitcoin commentator, predicted an explosive Q4 for Bitcoin and U.S. markets, largely due to the anticipated interest rate cuts.