Key Takeaways

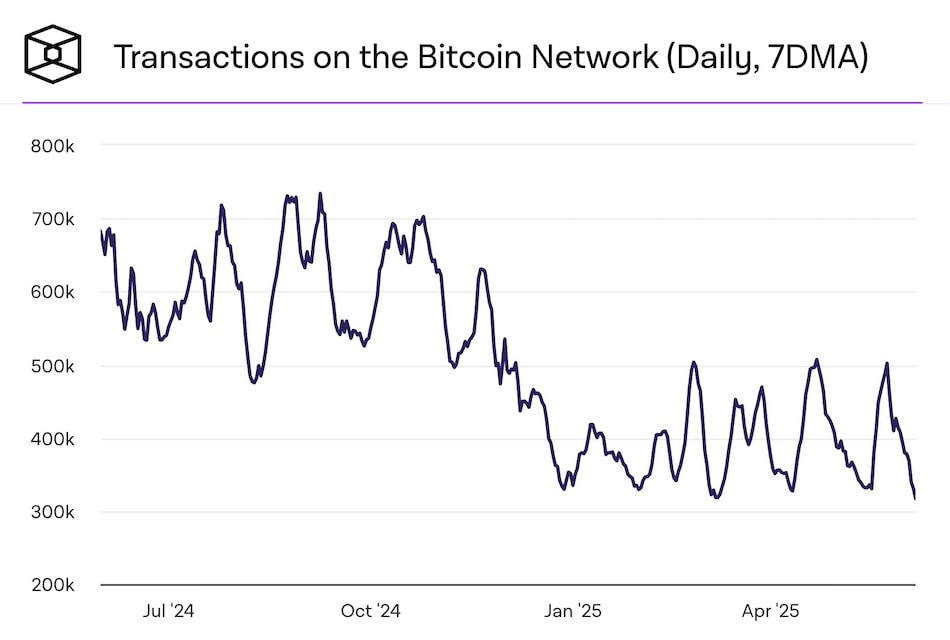

- Bitcoin onchain activity has dropped to its lowest point since October 2023.

- Large transactions now dominate onchain volume, with whales accounting for 89%.

- Off-chain trading, especially in futures, has surged and dwarfs onchain volume by up to 16 times.

Bitcoin’s onchain transaction activity has fallen to its lowest levels since October 2023, with daily transactions recently ranging from 320,000 to 500,000—down from a peak of 734,000 per day in 2024.

Analysts at Glassnode attribute much of the decline to a drop in non-monetary activities like Inscriptions and Runes, which previously inflated usage metrics.

Transaction trends

Despite the slowdown in overall onchain transactions, the average transaction size has increased significantly.

Glassnode reports an average volume per transaction of $36,200, with transactions over $100,000 now accounting for 89% of total volume, compared to 66% in late 2022.

Daily settlement on the Bitcoin blockchain is averaging $7.5 billion, with a peak of $16 billion seen during the initial $100,000 price break in November.

Fee pressure

Fee pressure has also eased.

Miner revenue from transaction fees has fallen to about $500,000 per day, with average fees at their lowest in 18 months.

This contrasts with prior bull markets, where increased prices led to network congestion and fee spikes. For further details, the bitcoin miner revenue chart provides additional context.

Off-chain volumes surge

Meanwhile, off-chain activity is booming. Centralized exchanges, especially in futures markets, now handle most of the trading volume. Bitcoin futures averaged $57 billion daily over the past year, peaking at $122 billion, while spot trading peaked at $23 billion. Combined, off-chain volume now exceeds onchain activity by 7 to 16 times.

The launch of U.S. spot Bitcoin ETFs in January 2024 has furthered this transition, contributing to a derivatives-led market structure.

“This transition can significantly impact how we interpret network metrics, as traditional indicators may no longer capture the full scope of market activity,” Glassnode analysts noted.