Key Takeaways

- Bitcoin has surged 10.77% in the past week, threatening $1.32 billion in short positions.

- Significant ETF inflows and on-chain accumulation indicate a bullish trend for Bitcoin.

- Analysts predict Bitcoin could reach $71,000 if the current trend continues.

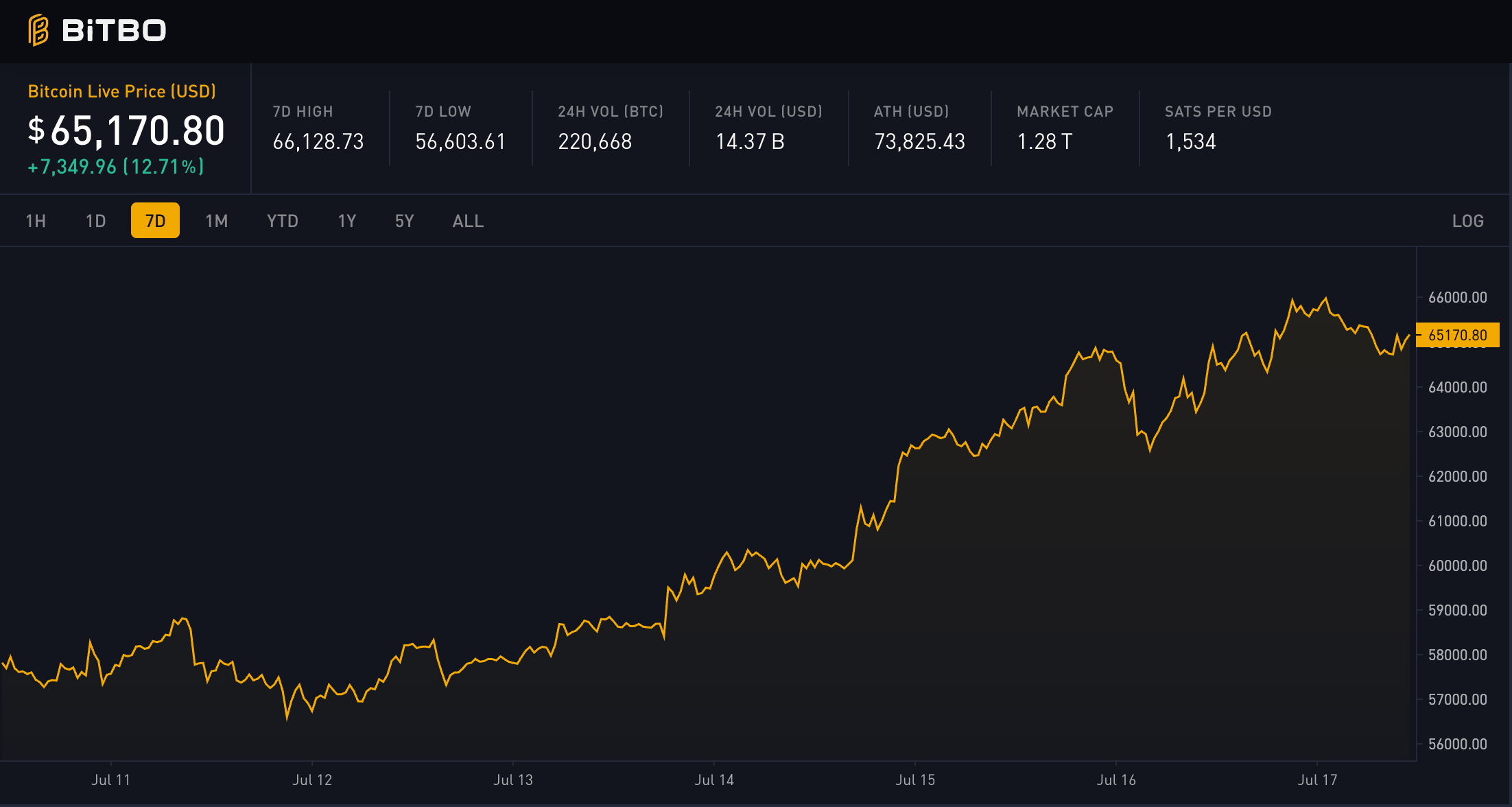

Bitcoin (BTC) has seen a remarkable performance over the past week, rising by 10.77%. Currently trading at $65,302, the price fluctuated between $65,000 and $66,250 in the last 24 hours. This surge threatens short positions, potentially leading to liquidations worth $1.32 billion if BTC reaches $68,066, according to Coinglass data.

The liquidation heatmap reveals that Bitcoin’s price could move towards $67,469 and $68,000. If these levels are cleared, the next target could be $72,599, bringing BTC closer to its all-time high (ATH).

Major Players Cease Bitcoin Sell-Off

Recent data highlights a significant inflow into Bitcoin ETFs, contributing to the price increase. Analyst Timothy Peterson noted that cumulative net ETF flows reached a new ATH last week, suggesting BTC could hit $71,000 soon. Peterson stated:

This marks 6 consecutive days of positive inflows totaling $1+ billion.

On-chain data indicates that large entities have stopped selling and have been accumulating BTC since July 13. The Accumulation Trend Score, now at 0.55, shows increasing on-chain purchases, supporting the bullish trend.

BTC Price Prediction: Bullish Trend Confirmed

Bitcoin’s daily chart shows a bullish trend, with the price above the 20 and 50 EMAs. Positive Cumulative Volume Delta (CVD) and Moving Average Convergence Divergence (MACD) readings further confirm this trend, suggesting the price could reach $68,235.

However, if large entities start distributing BTC again, the price might drop to $60,899.