Key Takeaways

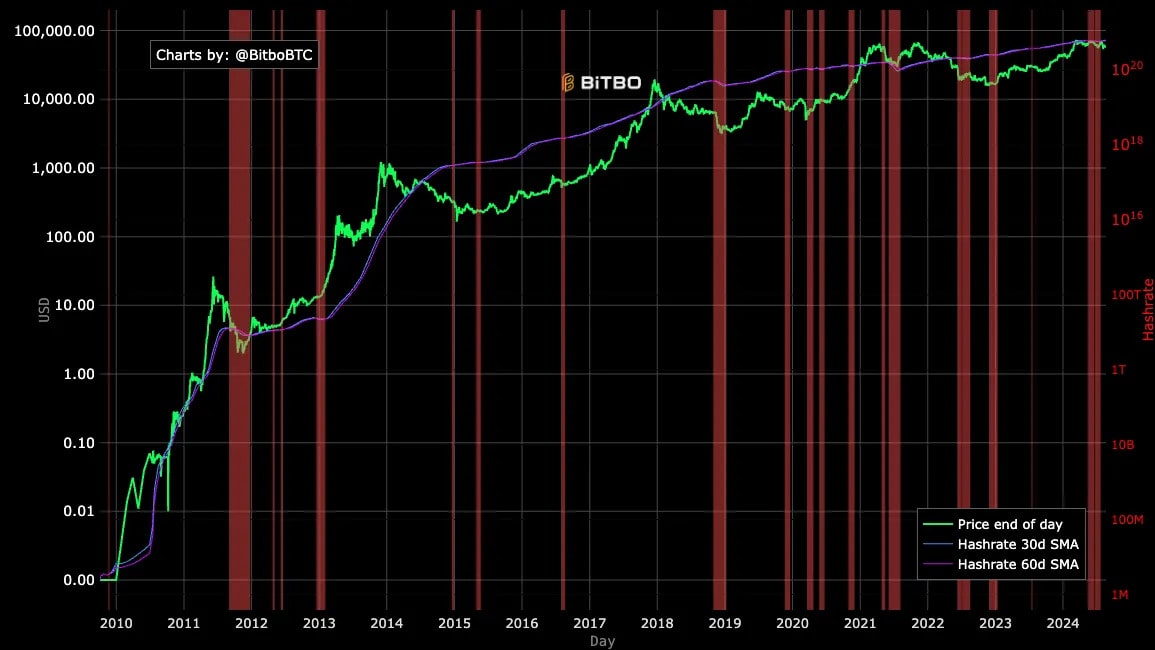

- Bitcoin Hash Ribbons signal an end to miner capitulation.

- Bitcoin mining difficulty hit an all-time high of 90.66 trillion on August 1.

- Miners like TeraWulf are diversifying into AI and high-performance computing services.

Bitcoin’s Hash Ribbons indicator has signaled a potential end to miner capitulation, according to CryptoQuant.

This indicator, based on the 30-day and 60-day moving averages, marks when miners switch to more efficient equipment, re-entering the market.

Price bottoms

According to CryptoQuant, the indicator typically aligns with price bottoms, providing investors a chance to “buy the dip.”

Despite this, miners continue to face profitability challenges.

On August 1, Bitcoin’s mining difficulty reached an all-time high of 90.66 trillion, slightly adjusting to 86.8 trillion since then. This rise in difficulty led to miner hashprice dropping to record lows under $36 PH/s, only recovering marginally to around $40 PH/s.

Diversification

The falling profitability has prompted some miners to diversify their operations.

For instance, TeraWulf has shifted part of its focus to artificial intelligence and high-performance computing, allocating resources to these sectors to stay profitable.

In July, the company announced plans to build AI and high-performance computing data centers at its Lake Mariner site.