Key Takeaways

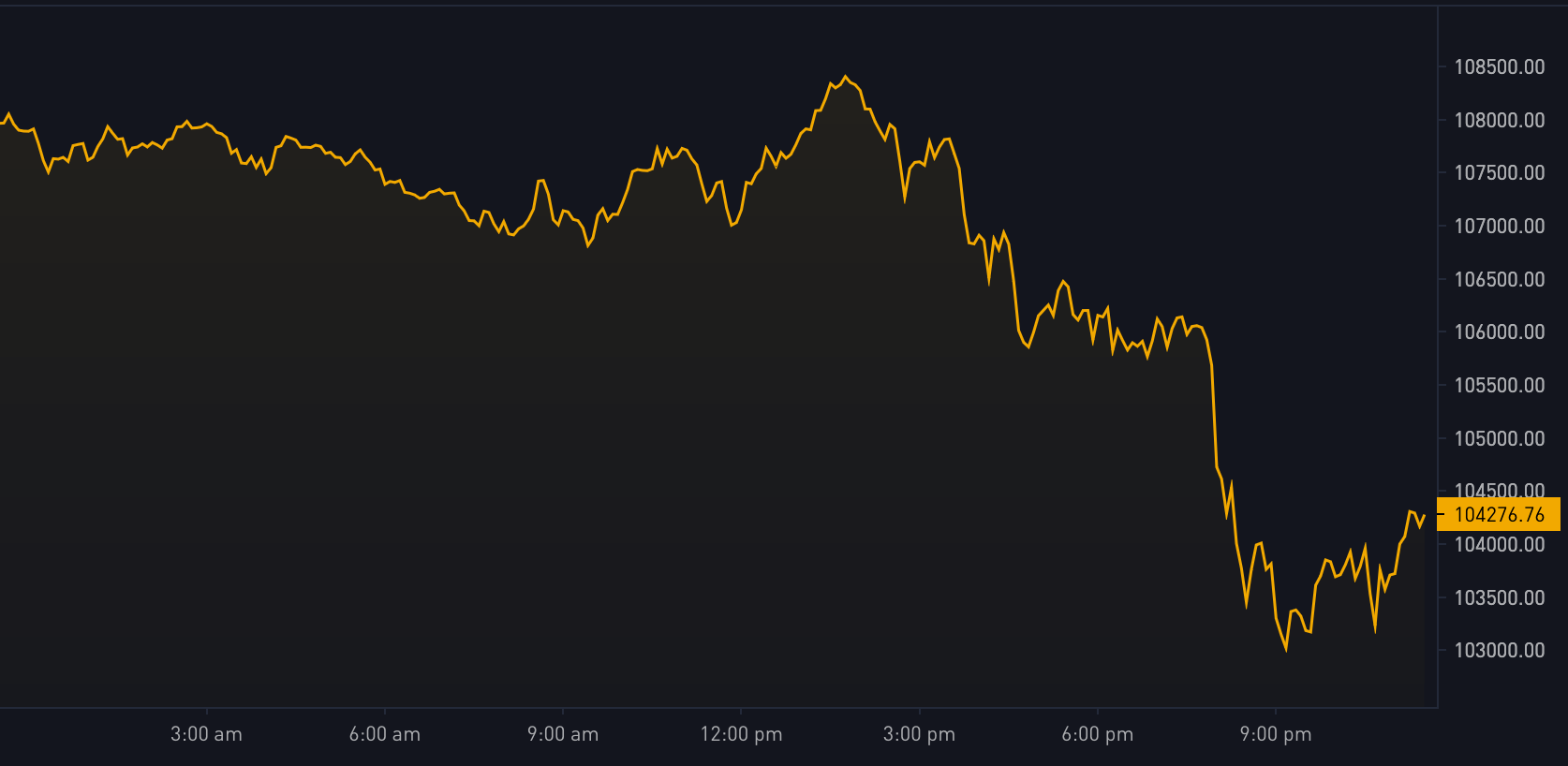

- Bitcoin dropped 5% to $102,900 after Israeli airstrikes on Tehran.

- Gold prices surged to $3,429 as investors sought safe-haven assets amid escalating geopolitical tensions.

- Leveraged liquidations across digital assets reached $1 billion in 12 hours, with long positions suffering the majority of losses.

Bitcoin slid 5% to $102,900 early Friday following Israeli airstrikes on Tehran, according to TradingView data.

The drop coincided with a spike in spot gold prices, which surged to $3,429 as investors sought traditional safe-haven assets amid the latest geopolitical turmoil in the Middle East.

Operation Rising Lion

On Thursday, bitcoin briefly rebounded to $108,450 from $107,000 but faced renewed selling after Israel launched “Operation Rising Lion.”

Israeli Prime Minister Benjamin Netanyahu declared:

“Moments ago, Israel launched Operation Rising Lion, a targeted military operation to roll back the Iranian threat to Israel’s very survival. This operation will continue for as many days as it takes to remove this threat.”

US Secretary of State Marco Rubio confirmed Israel had notified the US before conducting what officials called a necessary act of self-defense.

The strikes come as Iran faces censure from the International Atomic Energy Agency for failing to cooperate with inspectors, prompting Tehran to announce new uranium enrichment plans and advanced centrifuge deployment.

Market reaction and liquidations

US authorities have begun relocating diplomats out of Iraq and advising Americans to leave the region, citing “heightened regional tensions.”

Trump’s envoy Steve Witkoff stated that nuclear discussions with Iran would continue despite the ongoing conflict.

Bitcoin’s sharp decline led to significant market liquidations.

According to Coinglass, leveraged liquidations across major digital assets reached $1 billion in the past 12 hours, with long positions accounting for $937 million of the losses.