Bitcoin surged 11% from lows below $84,000 to over $93,000 after the Federal Reserve ended quantitative tightening (QT) and injected $38 billion in liquidity through repo operations on December 1.

This marked the largest such liquidity move since 2020, easing funding stress and boosting risk assets.

Fed liquidity boost drives rally

According to CryptoSlate, the New York Fed conducted approximately $25 billion in morning repo operations and another $13.5 billion overnight, coinciding with QT’s formal end.

This direct liquidity provision reduced borrowing costs and expanded the dollar supply, typically supporting high-beta assets like bitcoin.

The move came as US manufacturing data signaled economic slowdown, pushing rate-cut probabilities higher and stabilizing risk assets after the recent selloff.

Vanguard platform change amplifies demand

Vanguard, which manages about $9-10 trillion in assets, opened its brokerage platform to third-party bitcoin ETFs and mutual funds for the first time.

This created immediate demand pressure, with Bloomberg ETF analyst Eric Balchunas noting a “Vanguard effect” as bitcoin rose 6% around the US market open and BlackRock’s IBIT ETF saw $1 billion in volume in the first 30 minutes.

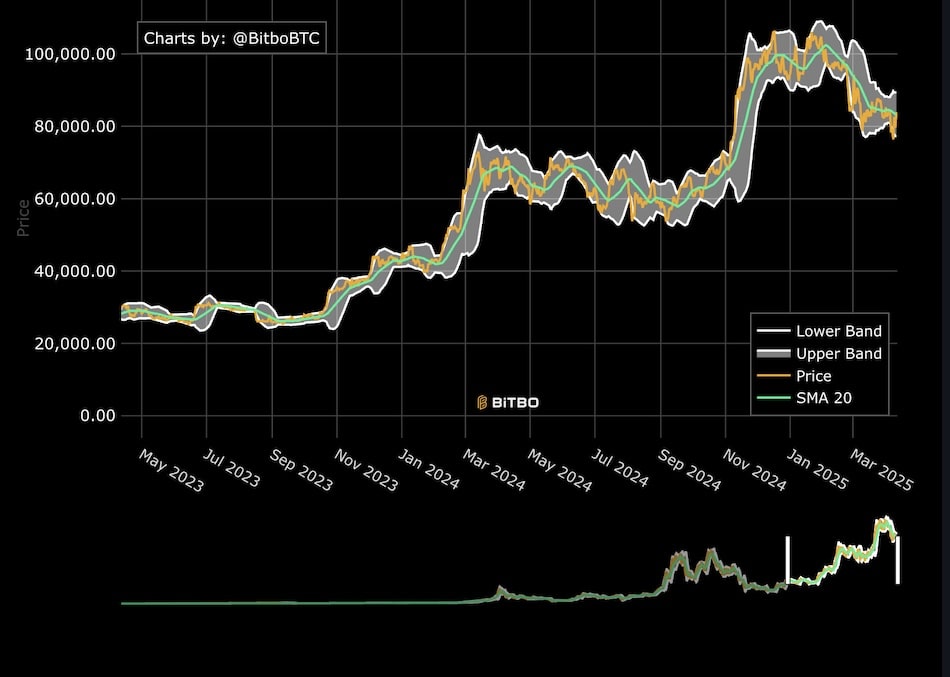

Market structure and sentiment

The rally was further amplified by market structure, with short-covering occurring after bitcoin broke resistance.

November had been the worst month for bitcoin in over four years, with the price dropping 17% and ETF redemptions exceeding $3.5 billion.

Despite the rebound, bitcoin remains down more than 30% from its October peak.

ETF sentiment and structural factors continue to play a significant role—track recent drawdowns and sentiment on the bitcoin price drawdown from all-time highs and fear and greed index.

CryptoSlate summarized the situation:

“The rebound reflects macro-driven relief from QT by the Fed and liquidity injections, structural tailwinds from Vanguard’s platform opening and slowing ETF outflows, and short-covering off a closely watched support level rather than a reversal of the broader downtrend.”