Key Takeaways

- Bitcoin ETFs hold 4-8 times more sway on BTC price than miners.

- Exchanges and ETFs collectively hold over 3.8 million BTC.

- Miners' weekly balance changes are minimal compared to those of exchanges and ETFs.

Bitcoin miners’ influence on BTC price action is minimal compared to the impact of Bitcoin exchange-traded funds (ETFs) and exchanges, according to Glassnode’s latest research.

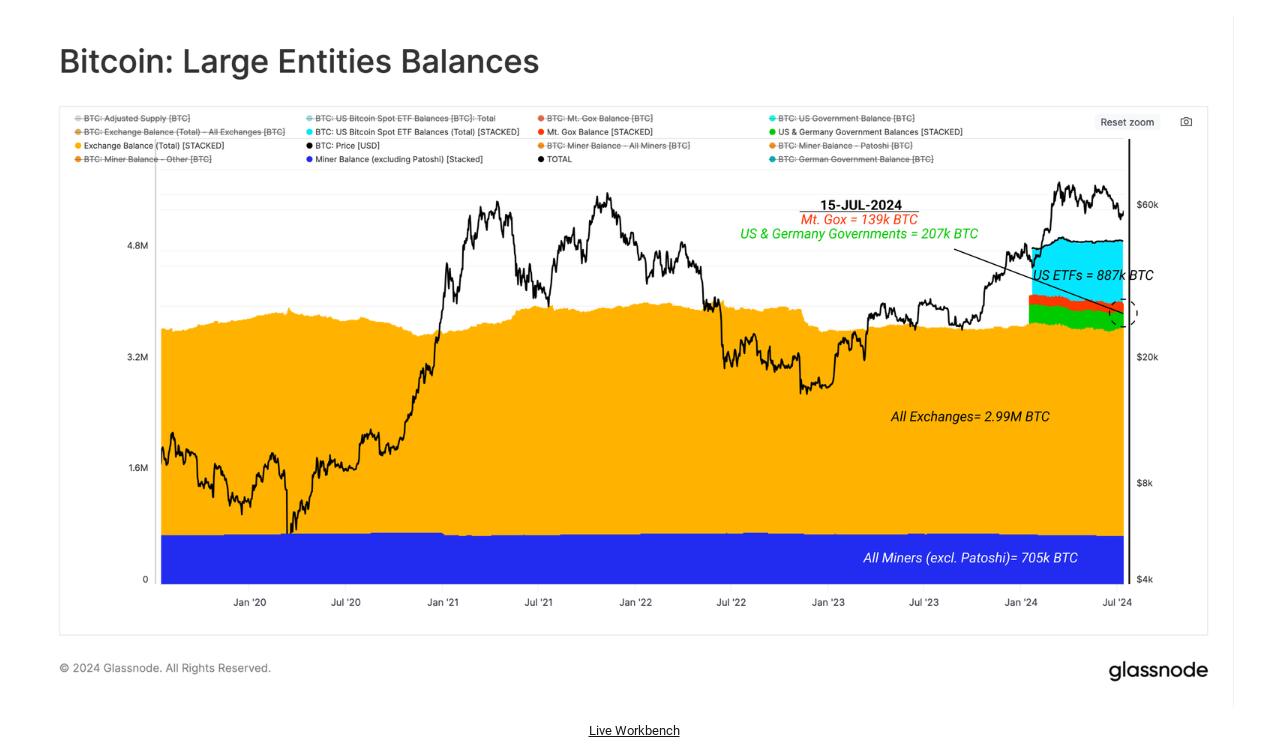

In its recent “The Week Onchain” newsletter, Glassnode highlighted that centralized exchanges and U.S. spot Bitcoin ETFs hold a far greater sway over BTC price movements than miners. As of July 2024, exchanges hold over 3 million BTC, while ETFs manage 887,000 BTC. In contrast, miner-affiliated wallets possess around 705,000 BTC.

Glassnode explained:

Through history, large coin holdings have ended up custodied by market agnostic entities, such as the Mt.Gox trustee. Similarly, significant coin volumes have been seized by government law enforcement.

11 ETF holdings

The report noted that the suite of 11 U.S. spot ETFs now holds a combined 887,000 BTC, marking their influence as second only to exchanges.

Weekly balance changes for miners hover around 500 BTC, dwarfed by the 4,000 BTC weekly fluctuations observed in exchanges and ETFs. This disparity indicates that exchanges and ETFs have a market influence 4 to 8 times greater than miners.

The German government’s recent distribution of 48,000 BTC further underscored the minimal impact of miners on BTC price. Markets had already priced in this multi-billion-dollar sell-off, providing a temporary relief for the BTC market.

Looking ahead, conditions for miners may improve as Bitcoin’s hash rate attempts to reach new highs, suggesting a potential rise in profitability.