Bitcoin is currently trading near $86,000, with significant unrealized losses building across spot ETFs, mining companies, and public treasuries.

Recent analysis from Checkonchain estimates that investors are carrying about $100 billion in unrealized losses, with around 60% of spot Bitcoin ETF inflows now underwater.

The average cost basis for these ETFs hovers near the $80,000–$82,000 zone, making this a pivotal support range for institutional investors.

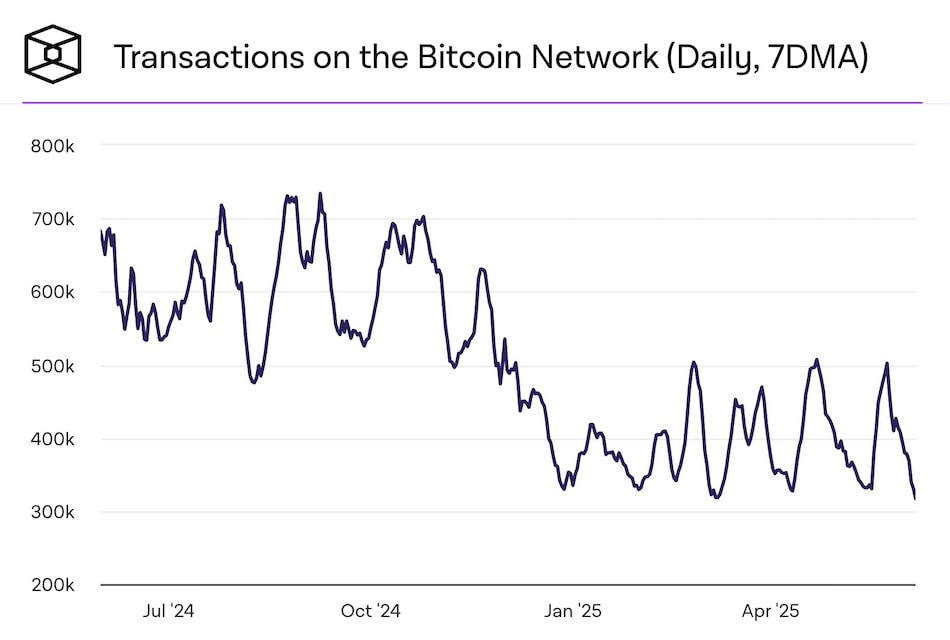

Market enters distribution phase

Miners are responding by pulling back network hashrate, while many treasury-company stocks are trading below their Bitcoin book value.

About $127 billion in ETF capital is concentrated near the $80,000 breakeven, but only a small portion sits in the $75,000–$85,000 range, providing limited downside protection.

Amberdata also highlights a denser zone of ETF capital between $65,000 and $70,000, meaning price drops below $75,000 could accelerate sell-offs.

Losses mount despite price rebounds

According to Glassnode, the realized loss among Bitcoin entities recently hit $555 million per day, the highest since the FTX collapse.

This elevated loss realization persists even as prices rebound, signaling ongoing market stress.

U.S. spot Bitcoin ETFs collectively hold about 1.3 million BTC, worth over $117 billion.

Miners and treasury equities under pressure

Mining economics have weakened, with Luxor’s Hashrate Index showing hashprice averaging $39.82 in November and falling to an all-time low near $35.06.

Miners are scaling back operations, which could foreshadow further margin compression or a sector-wide capitulation.

Meanwhile, many Bitcoin-focused public companies are trading at a discount to net asset value, hampering their ability to raise capital by issuing new shares.

This stalls the “issue equity, buy BTC” cycle that fueled corporate accumulation in prior years.

Macro risks amplify volatility

Bitcoin’s correlation with the S&P 500 and Nasdaq 100 has risen considerably, with current levels around 0.5—making it more sensitive to equity market swings.