Spot bitcoin exchange-traded funds (ETFs) in the U.S. recorded their second-largest daily net outflow on Thursday, with $903.11 million withdrawn across eight funds, according to SoSoValue data.

Major outflows hit leading bitcoin ETFs

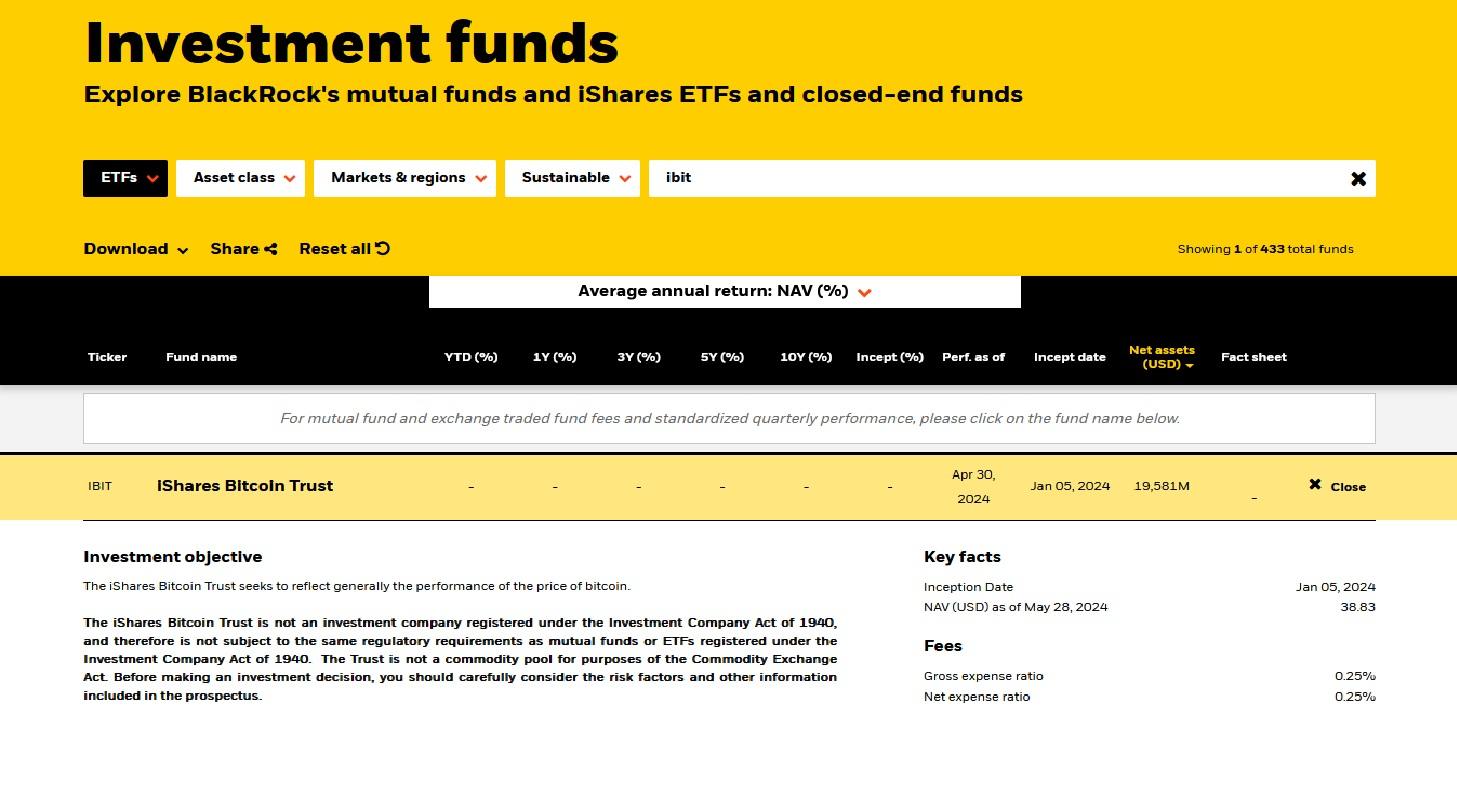

BlackRock’s IBIT, the largest spot bitcoin ETF by net assets, led the outflows with $355.5 million leaving the fund.

Grayscale’s GBTC saw $199.35 million in outflows, while Fidelity’s FBTC recorded $190.4 million in redemptions.

Other funds affected included Bitwise, Ark & 21Shares, VanEck, and Franklin Templeton.

Thursday’s outflows were the highest since February 25, when a surprise trade tariff announcement by President Donald Trump triggered a broad sell-off across both equities and bitcoin markets.

Sentiment shift follows earlier inflows

Crypto analyst Rachael Lucas of BTC Markets commented on the changing sentiment:

“[This is] a big sentiment shift from steady inflows earlier this month. And it’s not just crypto bleeding, Nvidia’s accounts receivable spike spooked equity markets, triggering a broader risk-off move. When tech giants wobble, liquidity tightens everywhere, and Bitcoin feels the pinch.”

Broader market declines add pressure

Nvidia, the world’s top chipmaker, reported strong Q3 revenue growth, but rising accounts receivable raised concerns among traders, contributing to a 3.15% drop in its stock.

The S&P 500 and Nasdaq Composite fell 1.56% and 2.15%, respectively.

Bitcoin also declined, falling below $84,000 amid renewed doubts over a December interest rate cut.

ETF assets remain substantial despite outflows

Lucas noted that cumulative ETF inflows still total $57.4 billion, with total net assets at $113 billion, representing about 6.5% of bitcoin’s market cap.