Key Takeaways

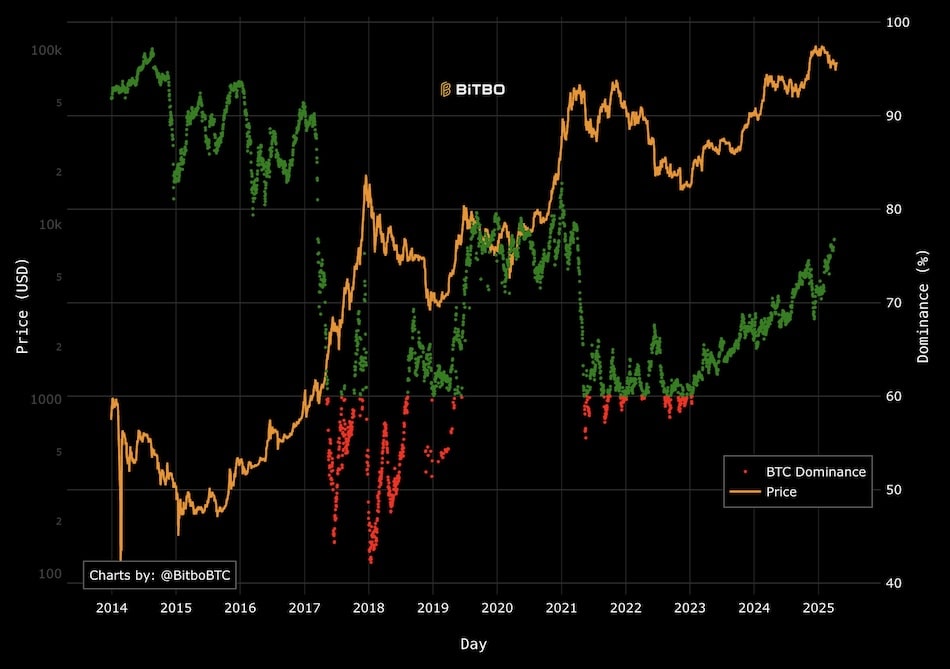

- Bitcoin dominance has risen to 63.80%, nearing a 4-year high.

- The last time BTC dominance was this high was January 2021.

- Ethereum-to-Bitcoin ratio has dropped to 0.01913.

Bitcoin is closing in on its highest level of market dominance in more than four years, reaching 63.80% as of April 15.

The metric, which tracks Bitcoin’s share of the total cryptocurrency market capitalization, is approaching levels last seen in January 2021.

Price performance

This rise comes as Bitcoin’s price continues to defy global macroeconomic jitters and moves closer to reclaiming its “Liberation Day” high near $86,000.

At the time of writing, BTC is trading at $85,877, up 1.19% from the previous day.

Market comparison

The increase in dominance underscores Bitcoin’s relative strength against both alternative digital assets and traditional equity markets.

The Nasdaq 100, for example, remains 5% below its comparable “Liberation Day” peak.

Altcoin performance

Meanwhile, the Ethereum-to-Bitcoin ratio continues to decline, currently at 0.01913 — down 0.31% — highlighting weaker performance from other major cryptocurrencies.

Growth factors

Bitcoin dominance has been steadily climbing through 2024 and into 2025, boosted by a mix of institutional demand, spot ETF inflows, and broader skepticism toward altcoins.

Network metrics

Current network data also supports Bitcoin’s growing share of the market.

The seven-day average hashrate stands at 896 EH/s, and daily fees generated are 6.33 BTC, or about $536,017.

Market leadership

The continued climb in dominance has positioned Bitcoin as the clear leader in the digital asset space as investors seek stability amid global uncertainty, including tariff tensions and fears of recession in the U.S.