Key Takeaways

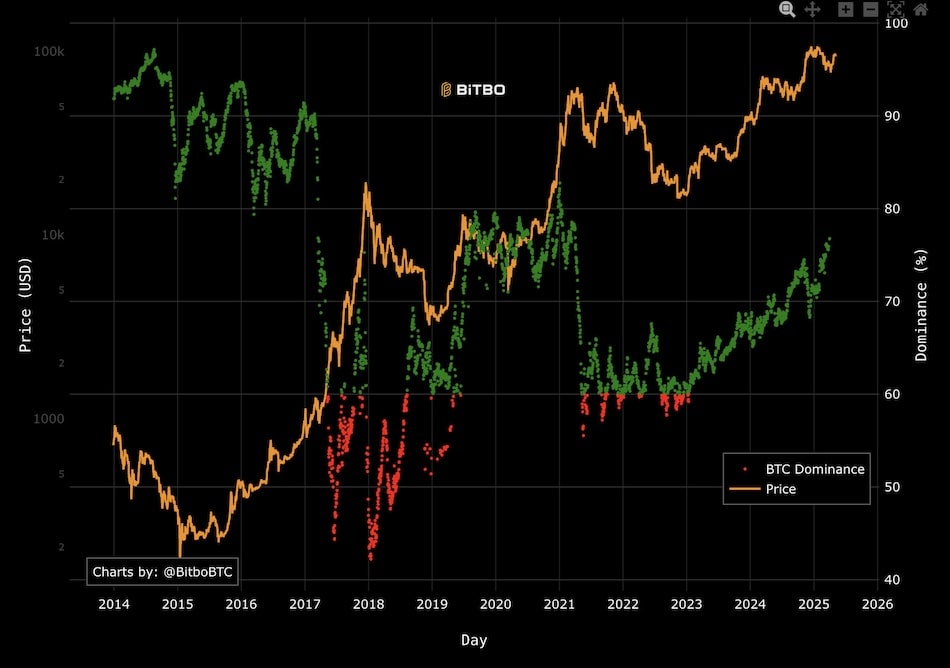

- Bitcoin dominance hits 64.98%, the highest since January 2021.

- Institutional moves, like Metaplanet's $25M bond raise, are boosting Bitcoin's share.

- Altcoins remain in decline, with Ethereum down 54% from its high.

Bitcoin now accounts for nearly 65% of the total digital asset market, its highest share since January 2021, as investors move away from altcoins and into what they view as a safer asset.

As of early May, Bitcoin’s price is just under $97,000 with a market cap approaching $2 trillion, compared to $3 trillion for the entire digital asset market.

Institutional influence

This surge is fueled by growing institutional activity.

Japanese firm Metaplanet raised $25 million through bond sales to acquire more Bitcoin, while Prime Two announced it would abandon Ethereum in favor of a Bitcoin-only strategy.

Meanwhile, Strategy has continued to accumulate Bitcoin and now controls over 2.5% of the total supply.

Market analyst insights

David Morrison, Senior Market Analyst at Trade Nation, said:

It has high acceptance relative to its peers… and its supply is strictly limited. Investors can now see a decent history of bounce-backs following large pullbacks.

Economic factors

April’s U.S. jobs report also played a role.

With nonfarm payrolls rising 177,000—well above the expected 133,000—hopes for imminent rate cuts have dimmed, making investors wary of speculative altcoins.

Altcoins like Ethereum, Solana, and Dogecoin are down 54%, 43%, and 61% from their highs, respectively.

Future of altcoins

The question remains whether an altcoin season is near.

Some analysts point to the 65% dominance mark as a potential trigger, while others argue more macro and market signals are needed before capital shifts.