Key Takeaways

- Bitcoin's Bollinger Bands are at their tightest in a year, signaling imminent volatility.

- Analysts and John Bollinger himself anticipate an upside breakout for BTC.

- Onchain and macro metrics, including ETF flows and MVRV ratio, reinforce the bullish outlook.

Bitcoin is poised for heightened volatility as its price consolidates near key resistance, with the Bollinger Bands indicator signaling a potential breakout.

Bollinger Bands indicate major move ahead

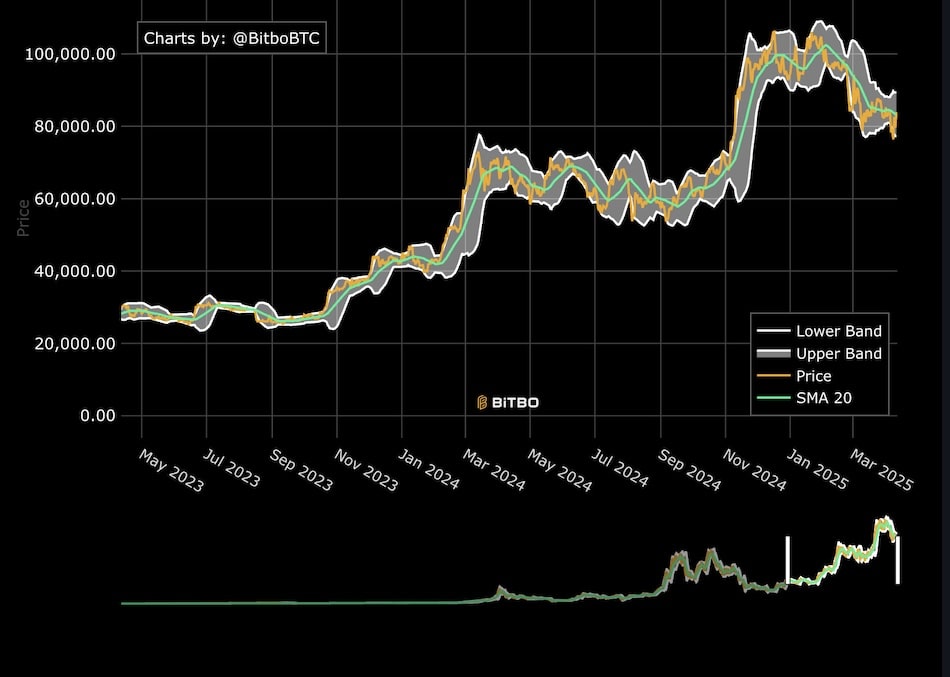

On Sunday, trader Crypto Rover highlighted that Bitcoin’s Bollinger Bands have tightened to levels last seen in February 2024 on the three-day chart, historically a precursor to significant price action.

He shared a chart noting the bands are “tighter than they’ve been” in over a year.

Bitcoin previously surged approximately 75% between February and March 2024 after breaking above the upper band, reaching its all-time high of $74,000.

Analysts

Some analysts now suggest a similar explosive move could send BTC to new record levels if history repeats.

Crypto Rover commented:

“Big pump incoming!”

Other observers, such as Cantonese Cat and market commentator Frank Fetter, have also noted the unusual compression, with Fetter stating in a recent post:

“The $BTC Bollinger Bands are pretty compressed — currently around yearly lows at a 9.4% price range.”

John Bollinger, the creator of the indicator, has turned bullish, posting:

“Bitcoin looks to be setting up for an upside breakout.”

Additional onchain and macro tailwinds

Analysts point to continued spot Bitcoin ETF demand, as well as a bullish MVRV Z-score currently above its 365-day average, as further evidence of an intact uptrend.

CryptoQuant’s Burakkesmeci explained that as long as MVRV remains above its average, bullish momentum tends to persist.

Expansion of the global M2 money supply is also cited as a positive macro factor supporting further price appreciation for bitcoin in the months ahead.