Key Takeaways

- Bitcoin has gained 49.2% year-to-date despite a weak Q3.

- Significant sell-offs and government sales weighed on Q3 performance.

- U.S. election results and ETF demand may drive Q4 gains.

Bitcoin continues to lead as the best-performing asset in 2024, despite facing a challenging third quarter.

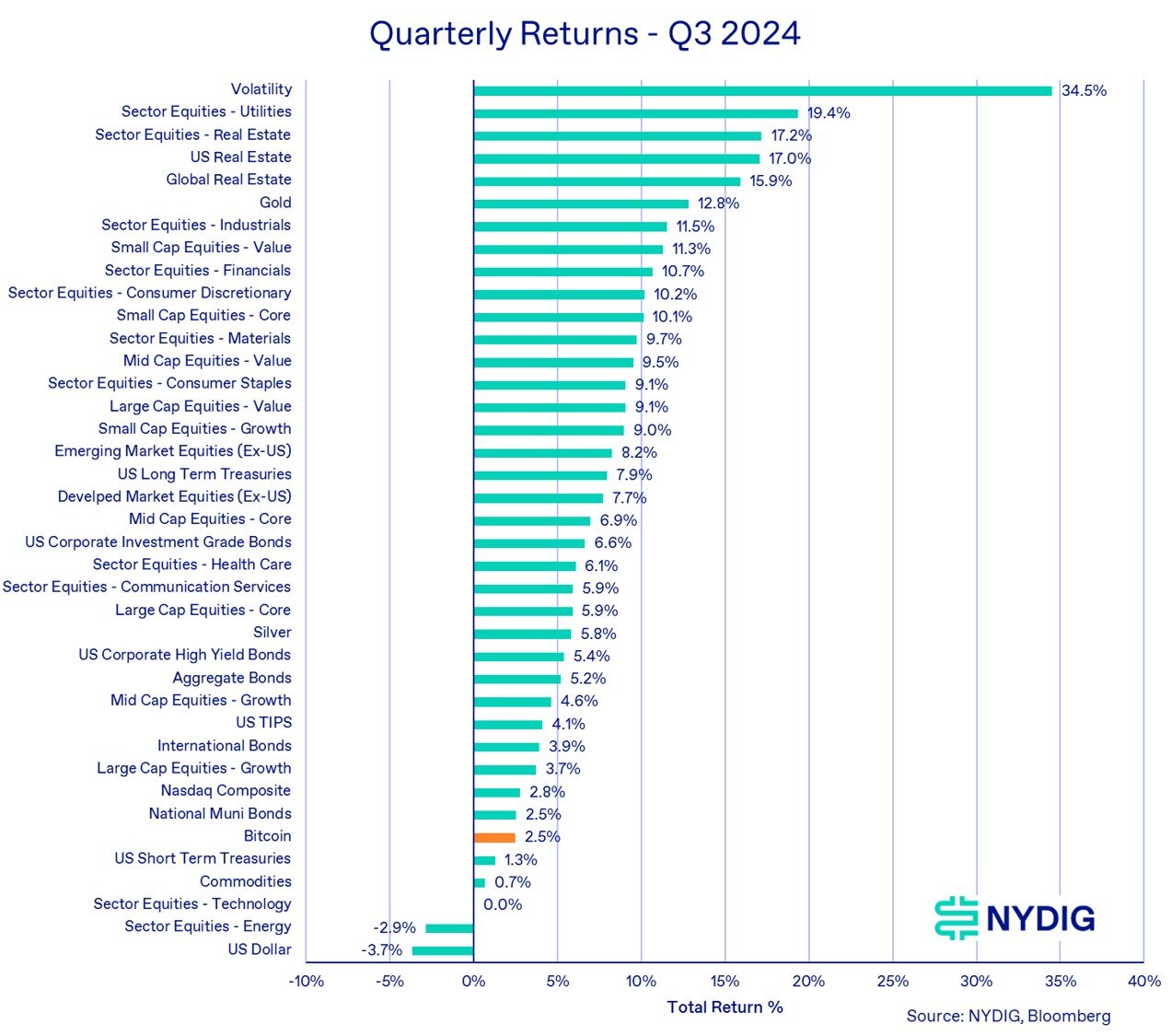

According to Greg Cipolaro, head of research at the New York Digital Investment Group (NYDIG), Bitcoin rose by 2.5% in Q3 after a difficult Q2.

However, its lead has narrowed as other asset classes also had strong performances.

Factors

Cipolaro highlighted that factors like significant sell-offs, including $13.5 billion from Mt. Gox and Genesis creditors, and government sales impacted trading.

Despite this, Bitcoin gained 10% in September, defying its usual bearish trend for that month.

Corporate holdings

The report also emphasized increased corporate Bitcoin holdings, with firms like MicroStrategy and Marathon Digital adding to their reserves.

Additionally, demand from U.S. spot Bitcoin exchange-traded funds (ETFs) played a role, accumulating $4.3 billion in total flows over the quarter.

Bitcoin’s correlation with U.S. equities rose to 0.46, but Cipolaro noted it still offers diversification benefits.

Looking ahead

Looking ahead, Q4 could see a stronger performance, driven by the U.S. presidential election on Nov. 5 and historical market trends.

Cipolaro reassured investors, saying:

Bitcoin is exactly where it was at this time in the previous two cycles.