Bitcoin network activity has dropped to its lowest point in twelve months, with the 7-day moving average of active addresses now at 660,000.

This marks a significant decline from December 2024, a period that saw a spike in usage due to Ordinals and Runes speculation.

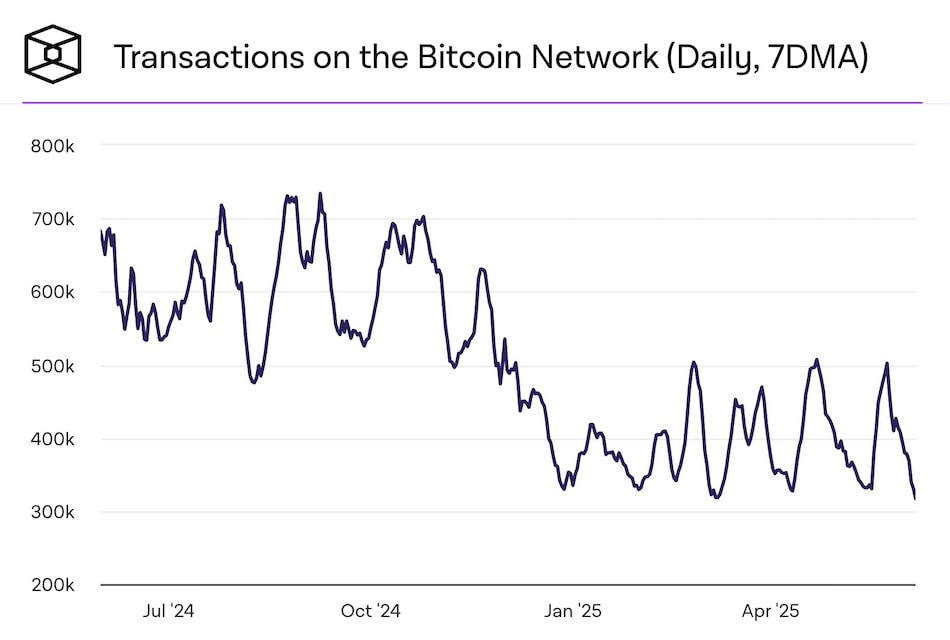

Activity metrics decline

Active addresses are now at lows not seen since late 2024, when innovations like Ordinals—allowing data inscriptions directly onto satoshis—and Runes—a protocol for creating fungible tokens—drove network traffic.

According to on-chain data, the current downturn coincides with decreased interest in these protocols and overall network usage.

Impact on miner economics

The slump in network activity has had a direct effect on bitcoin miners.

Daily miner revenue has dropped from an average of $50 million in the third quarter to roughly $40 million as the year ends.

The majority of this revenue now comes from the block subsidy, with transaction fees making up only a small portion, indicating reduced demand for blockspace.

Concerns over long-term blockspace demand

With half of bitcoin’s transaction throughput generating negligible fees, there is rising concern about whether future transaction fees will be sufficient to support miners as subsidies decline.

The network’s ability to attract users willing to pay for scarce blockspace will be critical for sustainable miner economics.