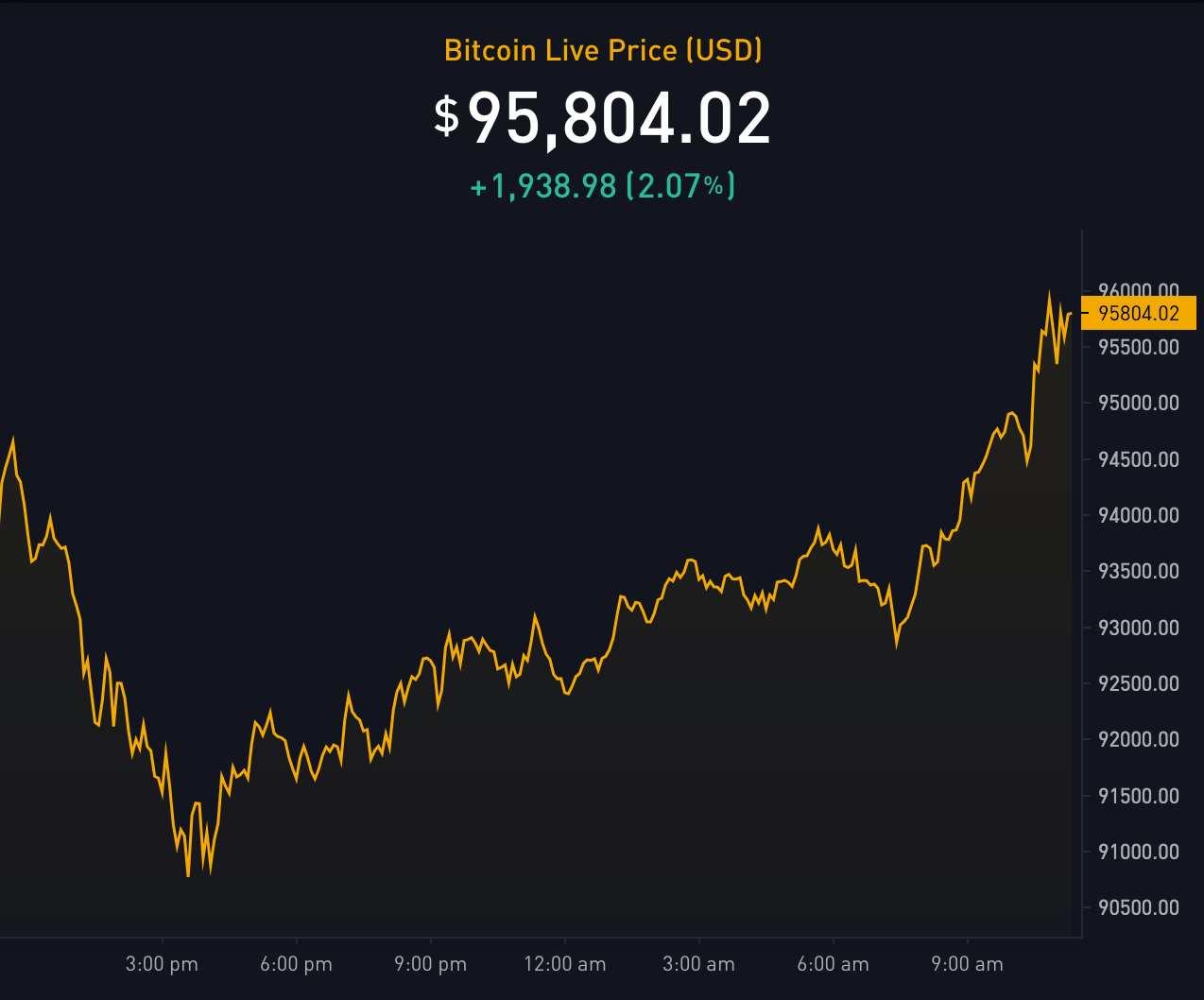

Bitcoin surged nearly 4% on November 27, climbing back towards $95,000 after dipping earlier in the week.

Market participants attributed the rebound to encouraging U.S. economic data, including jobless claims and the Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures (PCE) Index, which met market expectations.

Fed outlook

The Federal Reserve’s outlook also influenced trading, with CME Group data showing a 66% probability of a 0.25% interest rate cut next month.

However, the Kobeissi Letter highlighted ongoing inflationary pressures, questioning the longer-term trajectory of the Fed’s policy shift.

Market liquidity

According to trading analysis from Skew, the market saw renewed buying interest at lower levels.

Liquidity on exchanges like Binance remained wide, with demand building at $85,000 and sell orders thinning, which helped prices recover.

Passive buyers bought into both LTF (low time frame) lows.

Bullish indicators

Optimism about Bitcoin’s potential to reach $100,000 has resurfaced, bolstered by technical indicators like the Moving Average Convergence/Divergence (MACD).

The indicator’s bullish crossover prompted trader Bitcoin Munger to assert:

$100K is coming whether you like it or not.

Not all analysts were convinced, citing a significant sell wall at $100,000 that could cap upward momentum in the short term.

However, Roman, another trader, reminded market participants of the broader bull market trend:

We’re in a bull market. Stop being overly bearish.