Key Takeaways

- Bitcoin briefly reached $108K before dropping 2.4% in minutes.

- $1.3 billion in open interest positions were liquidated.

- Analysts warn of potential corrections erasing weeks of upside.

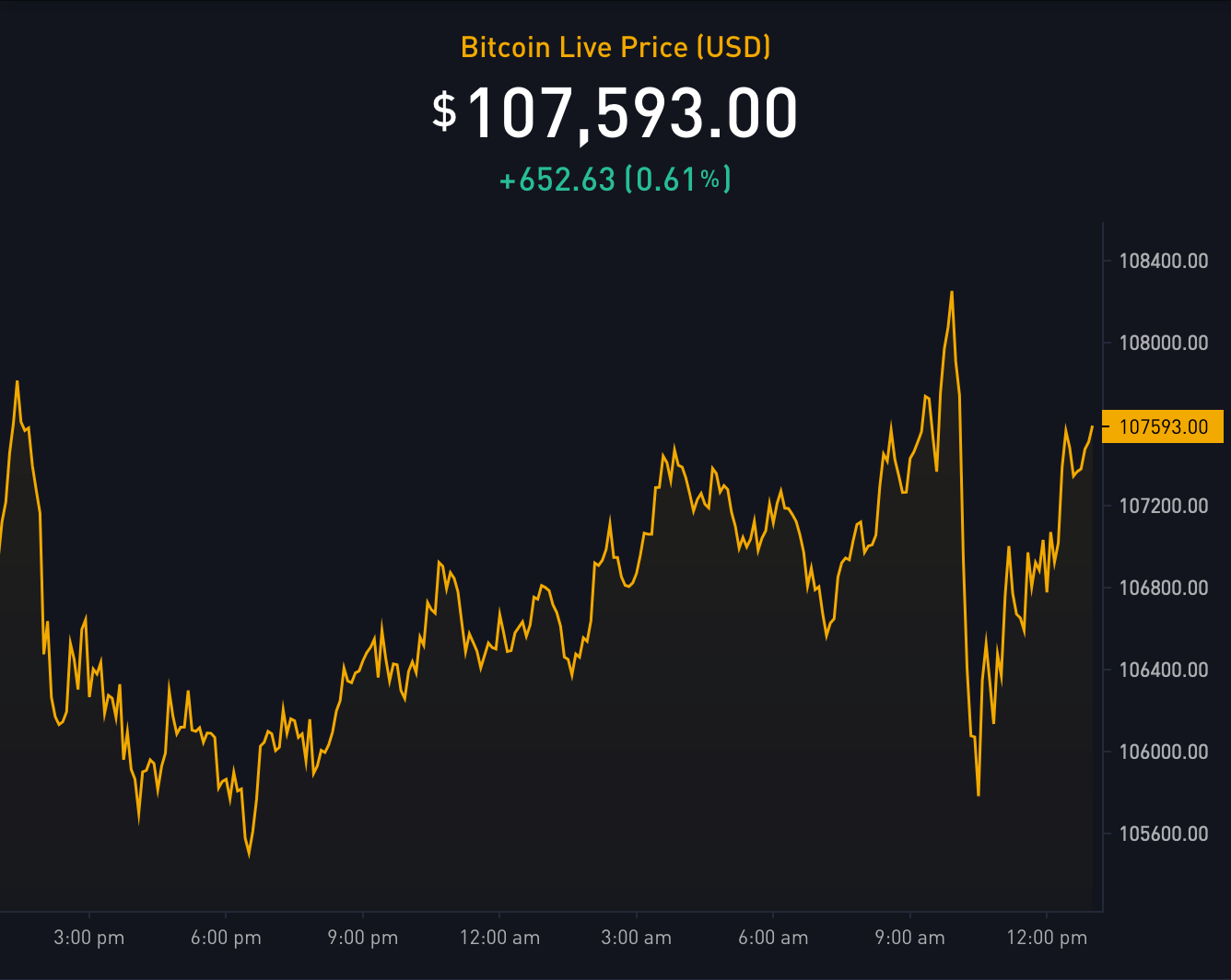

Bitcoin’s price experienced sharp volatility on December 17, briefly reaching an all-time high of $108,000 before swiftly retracing by over $2,000 to trade near $106,000.

Futures impact

The sudden dip triggered a significant impact on open interest (OI) in Bitcoin futures.

Data from CoinGlass revealed that $1.3 billion worth of positions were liquidated, erasing what had been record-high OI of over $70 billion.

Support levels

On-chain data platform Whalemap identified key support at $98,133, where large-volume holders had accumulated over 150,000 BTC.

Market analysis

Despite the pullback, QCP Capital observed that options market activity indicated a preference for hedging rather than aggressively betting on further upside, signaling caution among traders.

Taking a historical perspective, trader Rekt Capital compared Bitcoin’s price discovery phase to previous bull markets.

He noted:

- In 2013, BTC retraced during Week 7.

- In 2017, a -34% drawdown occurred in Week 8.

- In 2021, a pullback of -16% hit during Week 6.

Rekt Capital emphasized that while the exact timing remains uncertain, investors should brace for a potential correction that could erase multiple weeks of gains.

Trader Josh Rager, however, urged calm, saying pullbacks are “healthy” and anticipating higher prices over the next 3 to 6 months, extending into summer 2025.