Key Takeaways

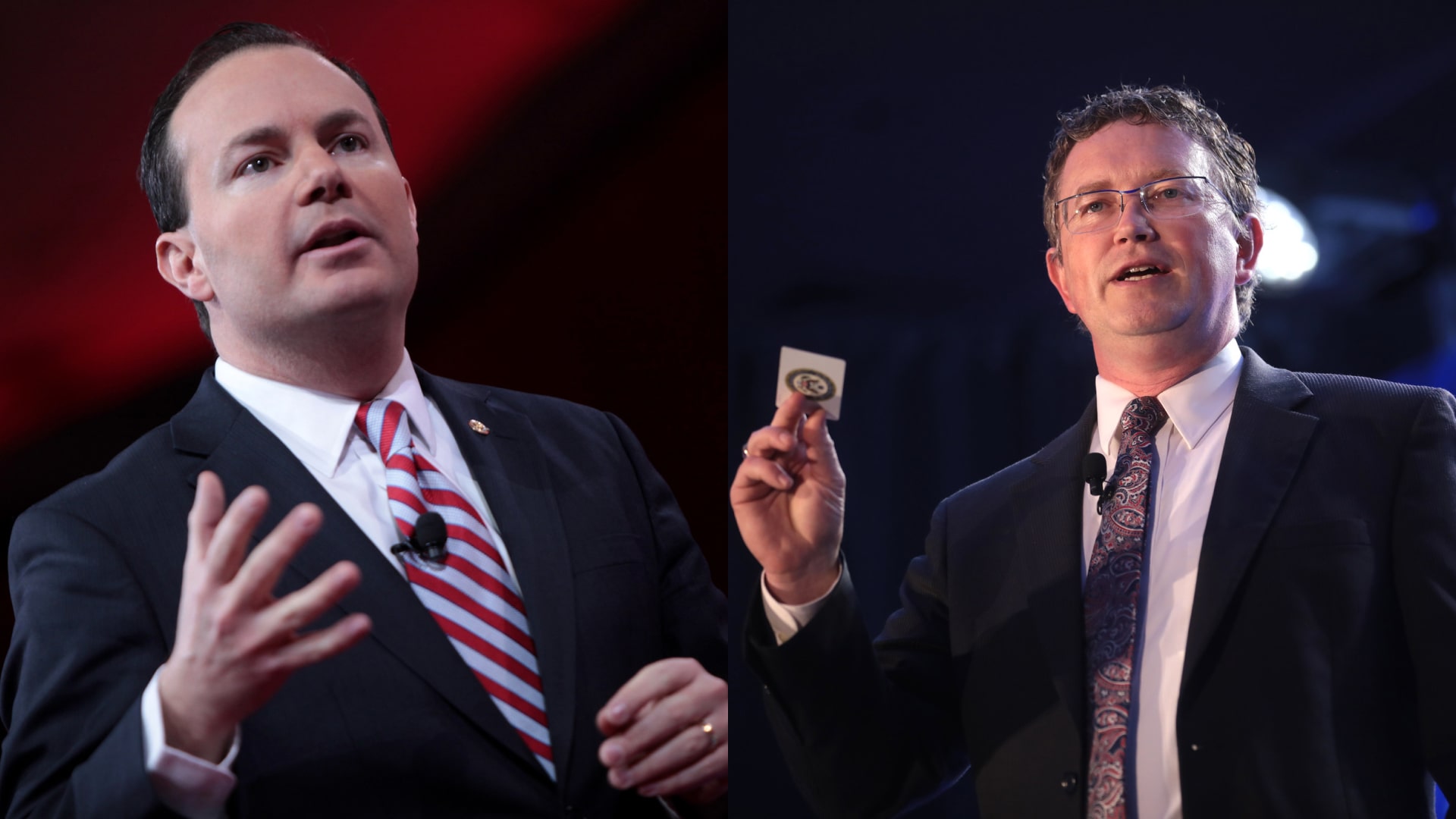

- Sen. Mike Lee and Rep. Thomas Massie introduce a bill to abolish the Federal Reserve.

- The bill proposes to dissolve the Board of Governors and repeal the 1913 Federal Reserve Act.

- Critics blame the Federal Reserve for economic issues such as inflation and financial instability.

Sen. Mike Lee and Rep. Thomas Massie have introduced legislation aiming to abolish the Federal Reserve.

The proposed bill seeks to dissolve the Board of Governors of the Federal Reserve System and the Federal Reserve banks, effectively repealing the 1913 Federal Reserve Act which established the system. This legislation reflects growing criticism over the Federal Reserve’s influence on the economy and government spending.

Sen. Lee. said:

The Federal Reserve has overstepped and repeatedly failed to achieve its mandate and become an economic manipulator that has directly contributed to the financial instability many Americans face today. This legislation aims to protect our economic future by dismantling a system that enables unchecked government spending, the monetization of federal debt that fuels it, and widespread economic disruption. It’s time to end the Fed.

Rep. Massie echoed Lee’s concerns, placing the blame for economic issues such as inflation on the Federal Reserve. Rep. Massie said:

Americans are suffering under crippling inflation, and the Federal Reserve is to blame. During COVID, the Federal Reserve created trillions of dollars out of thin air and loaned it to the Treasury Department to enable unprecedented deficit spending. By monetizing the debt, the Federal Reserve devalued the dollar and enabled free money policies that caused the high inflation we see today.

The bill stipulates that, if passed, the Federal Reserve would have a one-year period to wind down its operations and bookkeeping.