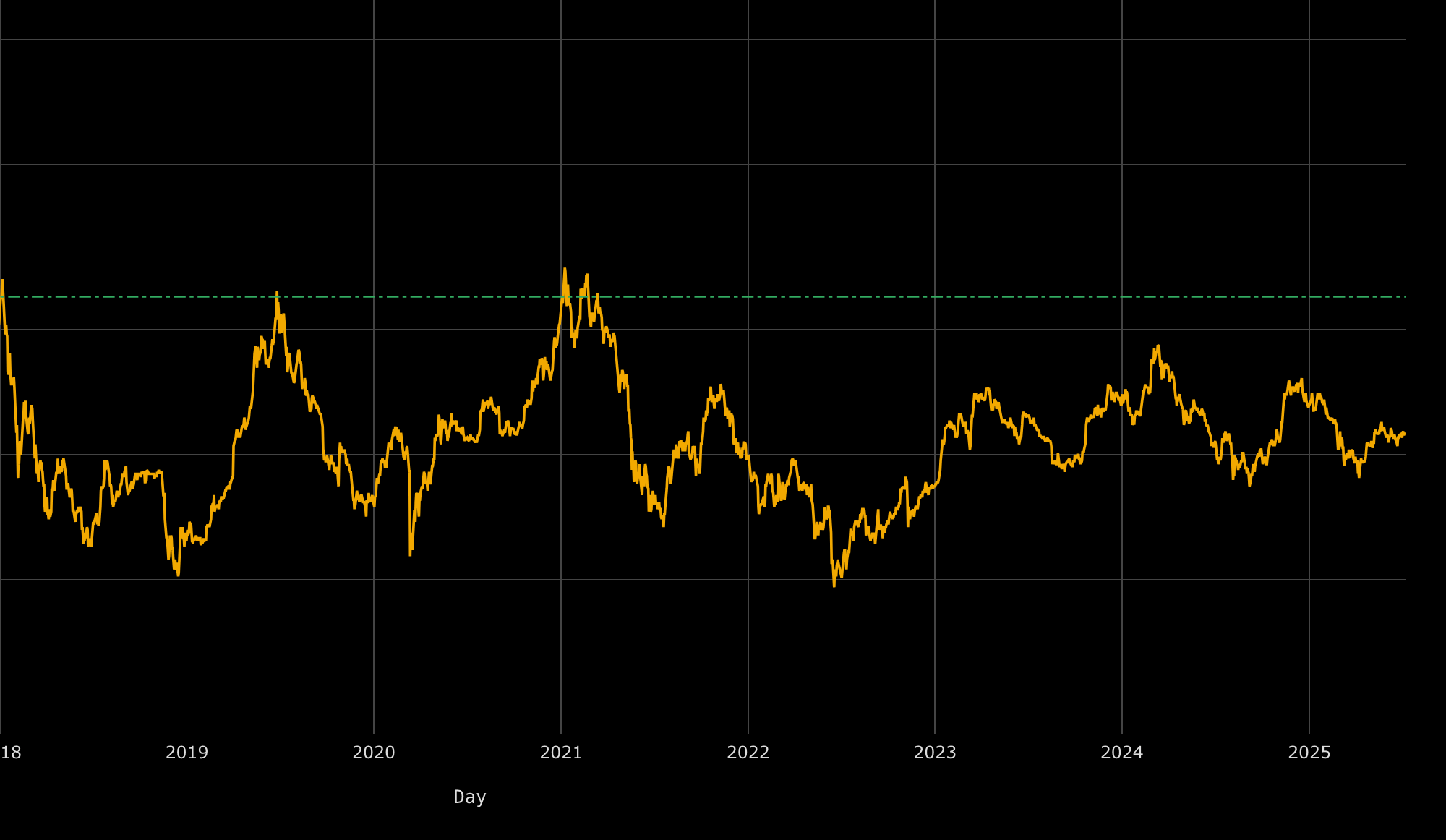

Bitcoin fell to about $60,000 on Feb. 5 in a sharp early-2026 selloff before rebounding toward $70,000 within days.

Miller Value Partners senior portfolio manager Bill Miller told CNBC he believes the move to $60,000 marked a market bottom.

Mining cost as a floor

Miller said bitcoin’s price hit its “cash production cost” around $60,000 for the first time this cycle.

He argued that level tends to act as a mechanical floor because unprofitable operators get forced out, reducing marginal sell pressure.

Miller said:

“Weak miners start going out of business.”

Fed liquidity swing

Miller also pointed to what he described as a “180-degree turn” in monetary conditions.

He said bitcoin’s fall 2025 peak aligned with the Federal Reserve draining roughly $50 billion per month from its balance sheet, before short-term funding markets saw “extreme stress” in December.

Miller said the Fed then shifted to buying $40 billion net per month, a $90 billion swing that he argued put a “huge floor” under risk assets.

On-chain capitulation signal

Finally, Miller cited an on-chain indicator showing the percent of supply in loss exceeding the percent in profit, which he described as a recurring marker of late-stage capitulation.