Key Takeaways

- Arthur Hayes expects a Bitcoin sell-off during Trump's inauguration.

- He warns against high market expectations for swift policy changes.

- Maelstrom plans to sell early, rebuying at lower prices in 2025.

BitMEX co-founder Arthur Hayes forecasts a significant Bitcoin sell-off coinciding with Donald Trump’s presidential inauguration in January 2025, challenging the prevalent market optimism.

Skepticism on pro-Bitcoin policy changes

In a Dec. 17 blog post titled “Trump Truth,” Hayes expressed doubt about the likelihood of immediate pro-Bitcoin policy changes under Trump’s administration.

He noted that this expectation is unlikely to be fulfilled, stating:

The market believes that Trump and his people can immediately achieve economic and political miracles.

Hayes foresees that the realization of policy delays could lead to a “harrowing dump” around the inauguration, affecting Bitcoin and other assets linked to Trump-related market optimism.

Maelstrom’s strategic moves

His investment fund, Maelstrom, plans to sell positions early and repurchase at lower prices in the first half of 2025.

Market realities & strategic adjustments

Hayes argues that any policy changes concerning Bitcoin reserves or regulation will necessitate extensive time and political maneuvering, contrary to market expectations.

He explained:

Trump has, at best, one year to enact any policy changes.

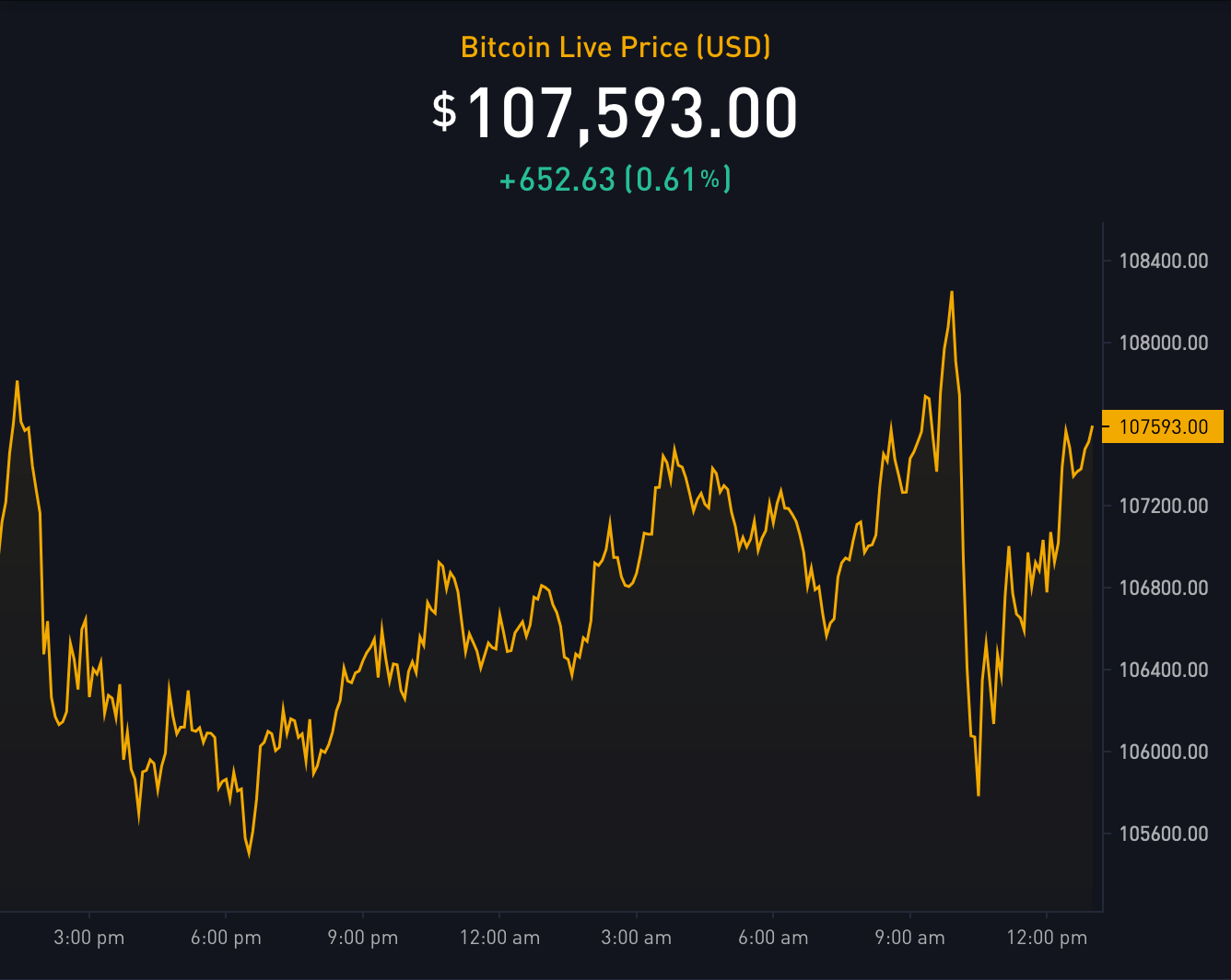

Despite recent Bitcoin rallies following Trump’s election victory, with the asset surpassing $100,000 by early December, Hayes advises caution.

He emphasized Maelstrom’s commitment to reassess if the bull market continues through inauguration day.

Divergent analyst opinions

Other analysts, including Matrixport, remain optimistic about 2025, predicting a strong start for Bitcoin.

However, rumors of potential selling restrictions, such as a blackout period for MicroStrategy in January, support Hayes’ bearish outlook.