Key Takeaways

- The Mayer Multiple currently sits at 1.1x, well below historical overbought levels.

- Analysts agree the indicator suggests bitcoin is undervalued and the bull cycle is not yet over.

- October 2025 is emerging as a likely target for the next bitcoin market top among analysts.

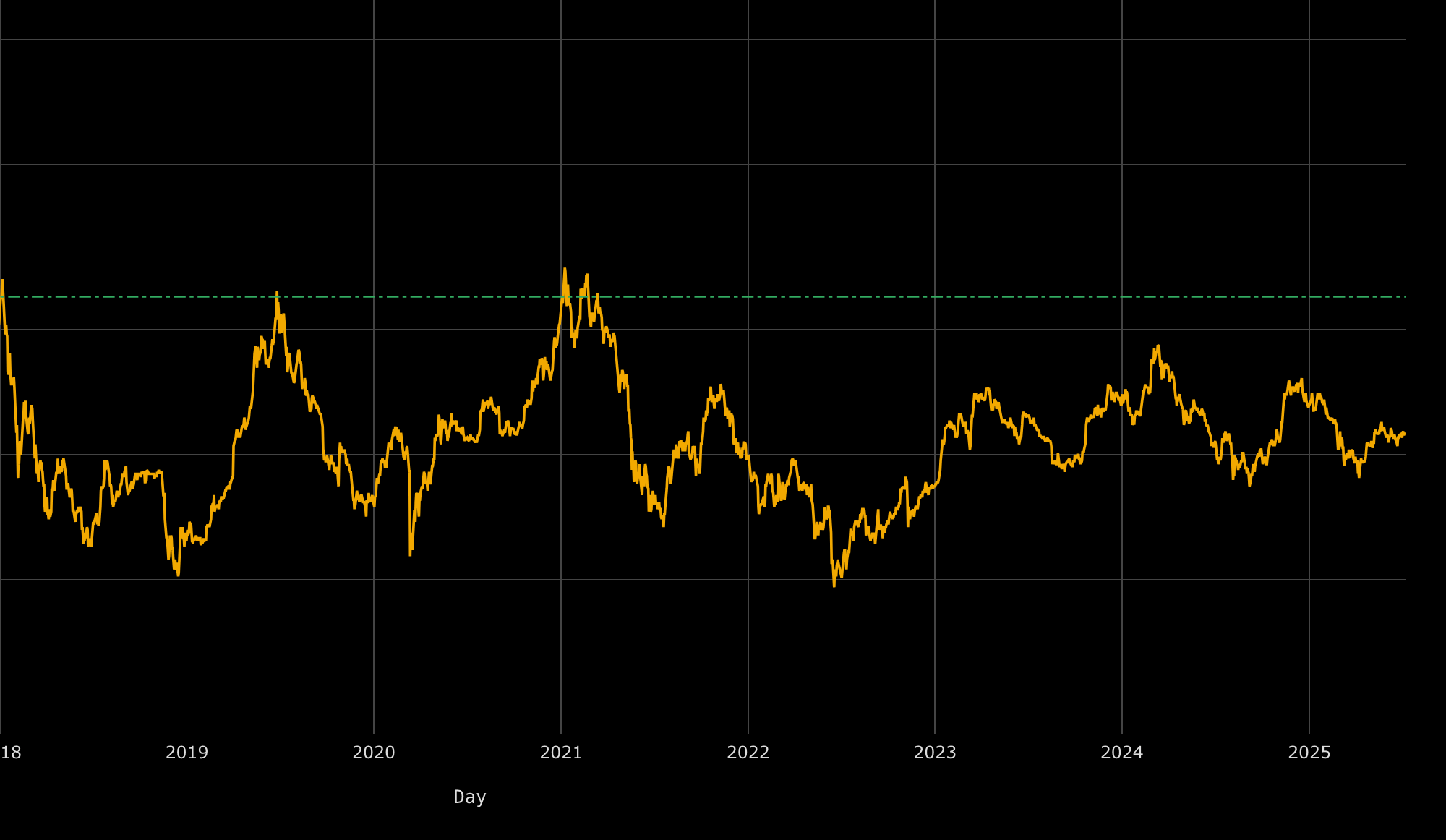

Despite bitcoin trading near its all-time highs after a 90% rally over the past year, analysts say the market is not yet overheated according to the classic Mayer Multiple indicator.

The Mayer Multiple, which compares the price of bitcoin to its 200-day moving average, currently stands at 1.1x.

This value is within the neutral zone of 0.8–1.5x and significantly below the typical overbought threshold of 1.5x. Onchain analyst Axel Adler Jr. commented:

Today’s Mayer Multiple indicates that Bitcoin is trading at a discount to its historical bull rallies and is rather undervalued than overvalued - a good fuel reserve for a new upward impulse.

Other metrics

This metric is among many onchain indicators that have yet to signal a market peak.

For example, a list of 30 “bull market peak” indicators tracked by CoinGlass reportedly remains fully in “hold” territory, reinforcing the view that a top has not yet been reached.

October 2025 eyed as cycle top

While the precise timing of a bitcoin cycle top is debated, more analysts are pointing to October 2025 as a potential likely period.

Trader and analyst Rekt Capital recently reiterated that, based on historical halving cycles, a bull market peak could arrive in September or October 2025.

Fellow trader Jelle also agreed with this timeframe, noting that profit-taking activity has already started but expecting the cycle top around October.

Analyst CryptoCon added that most data points to the cycle concluding by the end of this year, despite some expectations that the bull run could extend into 2026.

The Mayer Multiple can be tracked in real time on Bitbo’s Mayer multiple chart or on the Bitbo dashboard.