Key Takeaways

- Peter Brandt speculated about a potential 75% Bitcoin drop, similar to 2022.

- Analysts argue that current macroeconomic conditions differ significantly from 2022, making such a decline unlikely.

- Michael Saylor and others firmly reject the idea of a major Bitcoin crash at this time.

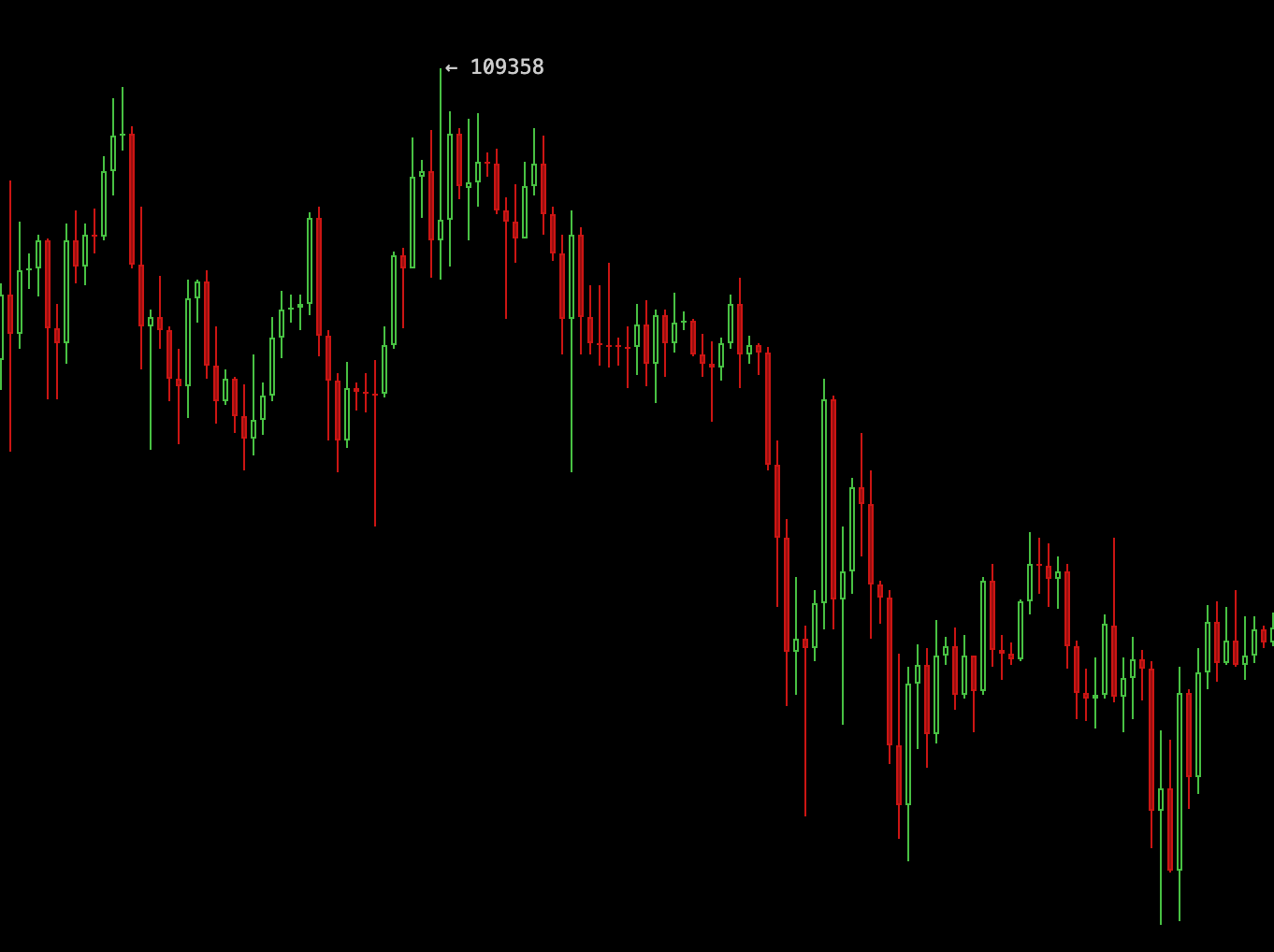

Veteran trader Peter Brandt recently speculated on X that Bitcoin could repeat its 2022 pattern and face a 75% correction, but analysts are pushing back against the likelihood of such a decline.

Brandt’s speculation sparks debate

Brandt questioned whether Bitcoin would follow its 2022 trajectory, when it fell by 76% from its November 2021 all-time high of $69,000 to around $16,195 by November 2022.

Brandt posted on Tuesday:

Is Bitcoin $BTC following its 2022 script and setting up for a 75% correction? Doesn’t hurt to ask this, does it?”

If a similar drop occurred from the current price of $107,810, Bitcoin would fall to about $26,000—a level last seen in September 2023.

Analysts cite different fundamentals

Swyftx lead analyst Pav Hundal dismissed the scenario, saying:

“Never say never; it just feels very unlikely at the moment. The difference in macro fundamentals between now and 2022 is profound.”

Hundal pointed to the unique economic conditions of 2022, marked by post-COVID stimulus and aggressive monetary policy tightening, compared to the current landscape.

Bitcoin analyst Andy Edstrom agreed that while some correction is possible, a 75% drop is not. He noted the 2021 cycle was “truncated” by the FTX collapse and the Federal Reserve’s hawkish shift, which are not factors today.

Collective Shift’s Simon Amery observed that monetary policy is now moving in the opposite direction, further reducing the risk of a sharp decline.

Saylor and others reject crash thesis

Bitcoin advocate Michael Saylor strongly dismissed the idea of another major downturn:

“Winter is not coming back. We’re past that phase; if Bitcoin’s not going to zero, it’s going to $1 million.”

Other analysts also believe current market sentiment and technicals do not support a major crash, emphasizing Bitcoin’s current position at a potential inflection point.