Coinbase vs Unchained: Which is Best? [2026]

Key differences

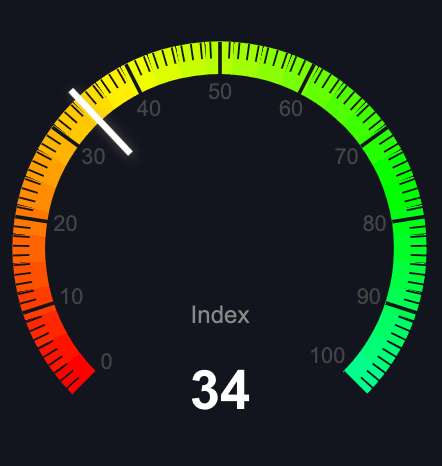

vs Unchained Fees Calculator

Enter an amount & we'll show estimated fees.

Fee Calculator

vs Unchained in Comparison

Description

US-based Bitcoin-only financial services company. Offers Bitcoin trading desk. Supports wire transfers with 1% fees.

Supported Countries

Available in all U.S. states besides New York, New Jersey, South Dakota, and North Carolina

Get started with one of these exchanges

Supported Cryptocurrencies

Bitcoin only.

Fees

- Trading Fees (Product-Based):

- Unchained Vault: 1.00% flat fee

- IRA: 1.50% flat fee

- Unchained Signature: 0.75% flat fee

- Minimum Trade Size: $2,000

Ready to start buying Bitcoin?

Payment Methods

Wire Transfer, Bank Account

Do These Exchanges Allow you To Earn Interest on Crypto?

Mobile App Ratings

iOS App: Not Available

Android App: Not Available

iOS Rating: 4.8 Official rating from the iOS App Store as of November 18, 2024.

Android Rating: 4.6 Official rating from the Android Play Store as of November 18, 2024.

Storage

Unchained uses a collaborative custody model with 2-of-3 multisignature security. You control two keys stored in separate locations, while Unchained secures a backup key. This ensures your bitcoin remains safe even if one key is lost or stolen. All bitcoin is stored offline in cold storage under your control - not on exchanges or hot wallets.

Have These Exchanges Been Hacked Before?

No customer funds have been lost. However, in March 2022, Unchained disclosed that their former email marketing provider ActiveCampaign was compromised. The breach exposed some client data including email addresses, usernames, and account status. No client funds or sensitive personal information was compromised.

Official Site

Exchange Review

No review available

"Great company, I’ve been a customer since 2021. Though they offer a free service, I opted for concierge onboarding and also opted for their inheritance option. I also plan to move my tradition and Roth IRAs from itrustcaptial to Unchained in the near future. Love that they now have an app 😎"

- Real user review from iOS App Store, Android Play Store or Trustpilot

Coinbase vs Unchained Comparison

Fee Structures

Unchained charges 1.00% on trades up to $100k, dropping to 0.50% for trades over $1M. Coinbase applies flat fees up to $200 (e.g., $0.99–$2.99), then charges a 0.50% spread and up to 3.99% for card purchases.

Unchained has no spread; Coinbase does.

Feature Set

Unchained is built for long-term holders with multisig wallets, IRA services, and inheritance planning. Coinbase offers broader features including over 240 supported assets, debit cards, USDC interest, staking, and a built-in wallet.

Geographic Availability

Unchained: Available in most U.S. states, but not in NY, NJ, SD, and NC.

Coinbase: Available in over 100 countries. Fully supported in all U.S. states except Hawaii (for Coinbase Card).

Security Features

Unchained: Uses 2-of-3 multisig cold storage with collaborative custody model. Users control two keys stored in separate locations, while Unchained secures a backup key.

Coinbase: Maintains full 1:1 reserves of customer assets with no lending. Features mandatory 2FA, multi-approval withdrawals via Coinbase Vault, and 24/7 monitoring.

Minimum Trade Requirements

Unchained: $2,000 minimum trade size

Coinbase: No minimum trade size

Customer Support

Unchained: High-touch, expert-led support with 5.0 rating on Google Reviews

Coinbase: Mixed reviews, massive user base with 4.7/5.0 rating on iOS and 4.6/5.0 on Android

Additional Features

Unchained: IRA services, inheritance planning, collaborative custody

Coinbase: USDC rewards (4.70% APY), debit card, staking, educational resources

Payment Methods

Unchained: ACH, wire transfer, Apple Pay

Coinbase: ACH, wire, bank, debit, PayPal, Apple Pay, Google Pay

Regulatory Compliance

Unchained: U.S. FinCEN, state-level MTL

Coinbase: NYDFS, global regulatory entities